Background

This investment case study involves a young couple who went to a smaller firm looking for a different strategy than the one they had at the time. They opted for an aggressive portfolio composition, knowing they had decades ahead to recover from any market downturns before needing to access their retirement funds.

That said, the couple wanted to take a less risky approach with their assets. They did not like to see their account fall in value during periods of market volatility. This happened to them during 2020, when the S&P 500 erased about 30% of its value in one month. With this information, the investment firm drew up a portfolio plan for them with a moderate asset allocation with 13 different positions to protect from larger account drawdowns.

For this case study, I am going to show you how this firm’s moderate asset allocation with its complex 13 position strategy provided almost no benefit, and to some degree was a detriment, than a simpler one with 3 positions.

I will focus on the four areas below. Under each area is a brief answer of why simpler is preferred if you wish to skip around the case study:

Four Areas

Portfolio Simplicity

📊 A portfolio of just 3 well-chosen ETFs provides the same diversification benefits as 13 positions, while drastically reducing complexity.

Risk Assessment

⚖️ The complex portfolio's volatility pattern mirrors that of the simpler portfolio, suggesting that the extra positions may not justify their added complexity from a risk management perspective.

Portfolio Return Analysis

📈 Historical data showed that a simple three-fund portfolio with roughly the same asset allocation mimics the more complex strategy's performance, even though it excluded international exposure.

Behavioral & Information Management

🧠 Fewer positions mean less information overload and fewer opportunities for emotional decision-making that can harm long-term returns through excessive trading and market timing.

Portfolio Simplicity

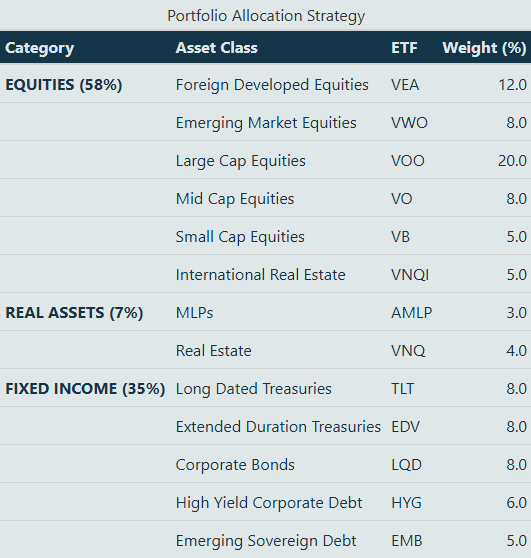

The firm decided to go with a moderate asset allocation of 58% equities, 35% fixed income, and 7% Real Assets that were split between 13 different assets. Of course, I cannot use real assets but there are ETFS, exchange traded funds, that mimic these particular assets. Here is the breakdown of their strategy:

(Click Here for our piece on ETFs if you aren’t familiar with them)

Here is our simple version while keeping the allocation weightings roughly the same:

A small note here: As you simplify the portfolio, you will have to lose exposure to other positions such as Emerging Markets, International, High Yield, etc. This may seem counter intuitive for diversification purposes but as you continue reading, you will soon find out the ineffectiveness of 13 positions in the risk and returns assessments.

With the Simple 3 fund portfolio we

Drastically reduced the complexity

Made it more transparent

Eased future behavioral concerns

There are many other benefits such as reduced trading costs, some tax implications and time spent managing the portfolio. However, I think the most important thing is that the portfolio is simplified. With that said, let us move on to show the ineffectiveness of the 13 positions on a risk and return basis.

Risk Assessment

In this section I want to discuss one very important item.

Volatility:

This is how much a stock's price moves up and down over time. A stock with high volatility has large, frequent price swings, while a stock with low volatility has smaller, more gradual price changes.

Instead of just one stock, I am using the entire portfolio of assets with their given allocation percentages. By comparing their volatilities (visually), we can get a sense of whether the proposed effectiveness of the 13 assets is better or is the 3-fund approach just as good. Here are the results:

From the chart we gain four important insights:

Both have similar volatility patterns in normal markets

The 3-fund portfolio shows similar volatility spikes

No evidence that additional complexity reduces risk

No evidence that 13 positions is more diversified than 3

The additional positions beyond core market exposures provide minimal volatility reduction benefits, if any. When analyzing the rolling volatility of both portfolios, adding more positions does not substantially decrease the overall portfolio volatility beyond what is achieved with the basic three-fund approach.

Simpler seems to be better.

Return Assessment

I want to highlight the returns assessment with caution and discuss why the returns are better for the 3-fund.

The 13-fund approach is exposed to international stocks and the 3-fund only has the VOO (US Stocks). International stocks have done a lot worse than US stocks coming out of COVID. Really since 2009 but who’s counting.

The focus here is the fact that their values move together or move close in unison. When one goes up, the other goes up and same on the way down. Again, we come across that this complex portfolio of 13 positions is not changing the way a portfolio behaves.

If you are interested in the returns, then here is the table below. Take these returns with a grain of salt because of the international exposure in the 13-fund. What we really want to focus here on are the allocations to Equities (about 60% for each), Real Assets (About 5% for each), and fixed income (35%). Even though each portfolio has the same allocation percentages to asset classes there is a different outcome between the two.

Below, is the metrics table that provides quantitative validation of our simplicity thesis. These topics are much more advanced in terms of understanding risk and return metrics. Each metric has a short definition to allow simple understanding of the concept.

Each key metric favors the three-fund approach:

Higher annualized returns by a lot (11.69% vs 8.22%)

Annualized Return: How much percentage made per year on average

Lower overall volatility - barely (13.45% vs 13.63%)

Volatility (Risk): Price swings of the portfolio up and down

Lower annual downside risk (VaR: -$20,083 vs -$21,926)

VaR: Maximum expected loss in any given normal year

Better annual tail risk protection (CVaR: -$42,537 vs -$58,310)

CVaR: Average loss during worst market scenarios

It is important to realize that a portfolio can be diversified and still achieve similar or better returns with only 3 funds.

Simple once again, seems to be better.

Behavioral & Information Management

The three-fund portfolio offers more than just simplicity in its structure - it provides psychological armor against our own worst investing tendencies. When investors face fewer investment choices, they are less likely to engage in harmful behaviors like frequent trading or attempting to time the market.

The reduced complexity means

Less time spent analyzing individual fund performances.

Reading market commentaries.

Getting swayed by the latest investing trends.

This behavioral advantage translates into better long-term returns. Investors are more likely to stick to their investment strategy during market volatility rather than making emotional decisions based on fear or greed.

In contrast, a 13-fund portfolio, while offering greater “diversification” across asset classes, introduces significant behavioral challenges. Each additional fund creates another data point to monitor, another performance metric to evaluate, and another opportunity for second-guessing. When managing multiple funds, investors often fall into the trap of over analyzing short-term performance.

This can lead people to

Turnover their portfolio excessively

Trying to chase returns

Changing their allocation on a short term basis

The cognitive overload of tracking and rebalancing 13 different positions is overwhelming, leading to decision paralysis or impulsive changes based on incomplete information. The complexity makes it harder to maintain a disciplined, long-term investment approach, as the abundance of choices and information can amplify behavioral biases and emotional responses to market movements.

Conclusion

This case study demonstrates that a simplified three-fund portfolio can match or even outperform a more complex 13-fund strategy across multiple key dimensions.

The analysis revealed that the complexity of managing 13 positions provided no meaningful advantages in terms of volatility reduction or risk management, while introducing more behavioral challenges and opportunities for emotional decision-making that harms long-term returns.

This evidence suggests that when it comes to investment strategies, more complexity does not mean better outcomes - in fact, the opposite holds true, with simplicity emerging as a powerful advantage for long-term investment success.