This is based on a true story about Steve (not his real name), who wanted to have it all.

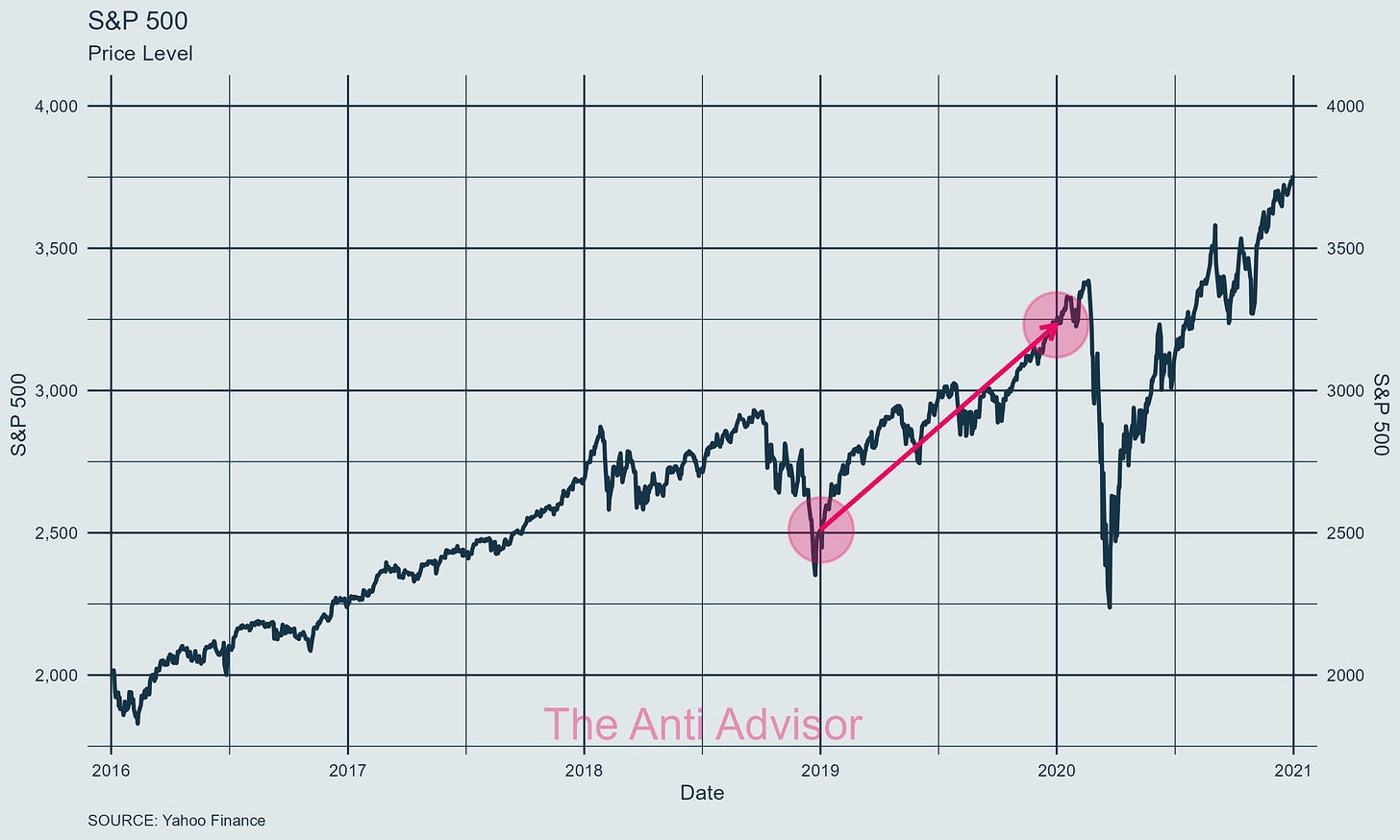

It’s mid-December of 2018. The S&P is on track to have its worst performing year since 2008. The S&P ends the year down roughly 6%.

However, it ends almost at the bottom of the market. This creates some interesting performance metrics at the end of 2019.

2019 was an amazing year and nothing stood in its way. For the lack of a better phrase, it went straight up. (Obviously it didn’t but might as well have)

The S&P 500 ended 2019 with a gain of almost 30% due to the low of 2018! A typical bond portfolio performed well at around 8% too.

It’s now the first quarter of 2020 and performance reviews are under way. Steve walks into the performance meeting with a disgruntled look on his face. We are a bit confused at what the problem could be.

We start by going through the yearly spiel on performance and Steve interrupts us as we say his portfolio was up 17%. He says,

“But the S&P 500 is up 30%!”

It is obvious that he is referring to our “under performance” of the market and his gains not coming close to the market for 2019. We hear this all the time.

“Well Steve, your portfolio isn’t the S&P 500. We can surely change that for you if you would prefer to be 100% equities. You can probably do that yourself and our services are no longer required.”

Of course we don’t say that and give him the standard,

“You have a diversified portfolio with uncorrelated asset classes and return profiles.”

The meeting ends well as we explain his position to him. Steve is experiencing what we call in the financial industry, FOMO. Actually, it is biases that include herding behavior, loss aversion and the desire to gain more. It doesn’t end there…

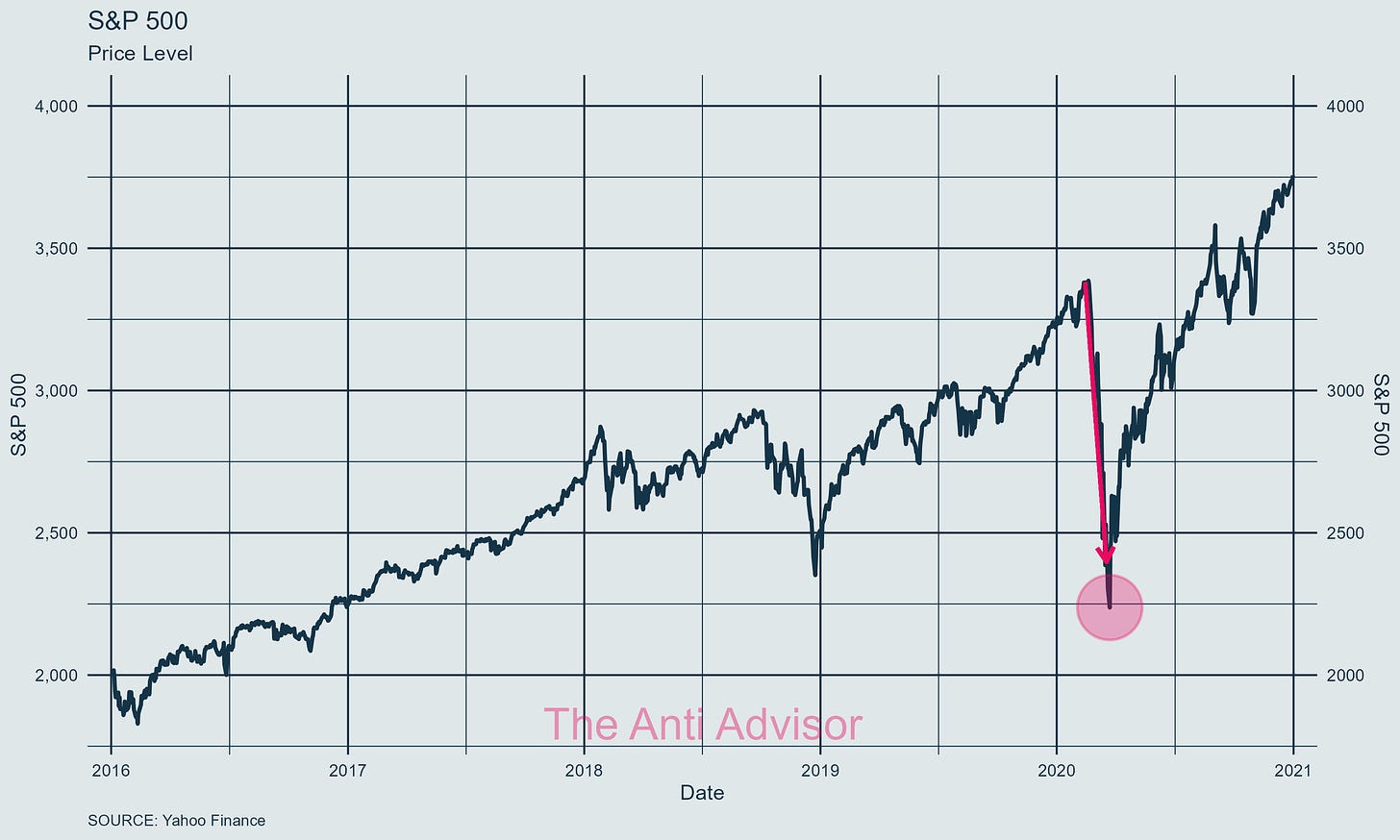

FAST FORWARD TO APRIL OF 2020.

I think we all know what transpired. The world stops and markets fall along with interest rates. It’s the second quarter of 2020 and we have reached out to our clients about portfolios and what the future holds (which none of us knew what the future held at that point).

The S&P 500 draws down about 33%!

Steve reaches out and the discussion shifts. His portfolio during this time only draws down 18% against the S&P, which was down about 33%. The conversation isn’t about the S&P anymore. It is now framed around his actual losses instead of upside gain.

Steve said,

“I thought we were protected from this?”

We said,

“You are. Your portfolio didn’t draw down as much as the S&P…”

Sometimes people don’t get it. He wanted the best of both worlds - maximum upside with minimum downside, which isn't realistically possible in investing. His biases combined to create an inconsistent and emotionally-driven approach to evaluating the investment performance, rather than maintaining a rational, long-term perspective aligned with his risk tolerance and investment goals.

Even as professionals, we don’t invest wholly into the S&P 500 because we know that a 33% drawdown is tough to stomach. It gets increasingly harder to stomach as the account value rises:

$100,000 draws down $33,000 (2024 Toyota RAV4 Hybrid)

$1 million draws down $333,000 (2024 Lamborghini Huracan Sterrato)

$10 million draws down $3.3 million (A very nice home: Use your imagination)

Steve never had $10 million. His account was much less. I couldn’t imagine if he had a drawdown of $1.8 million in 2020. He would be devastated and probably live in money market mutual funds the rest of his life.

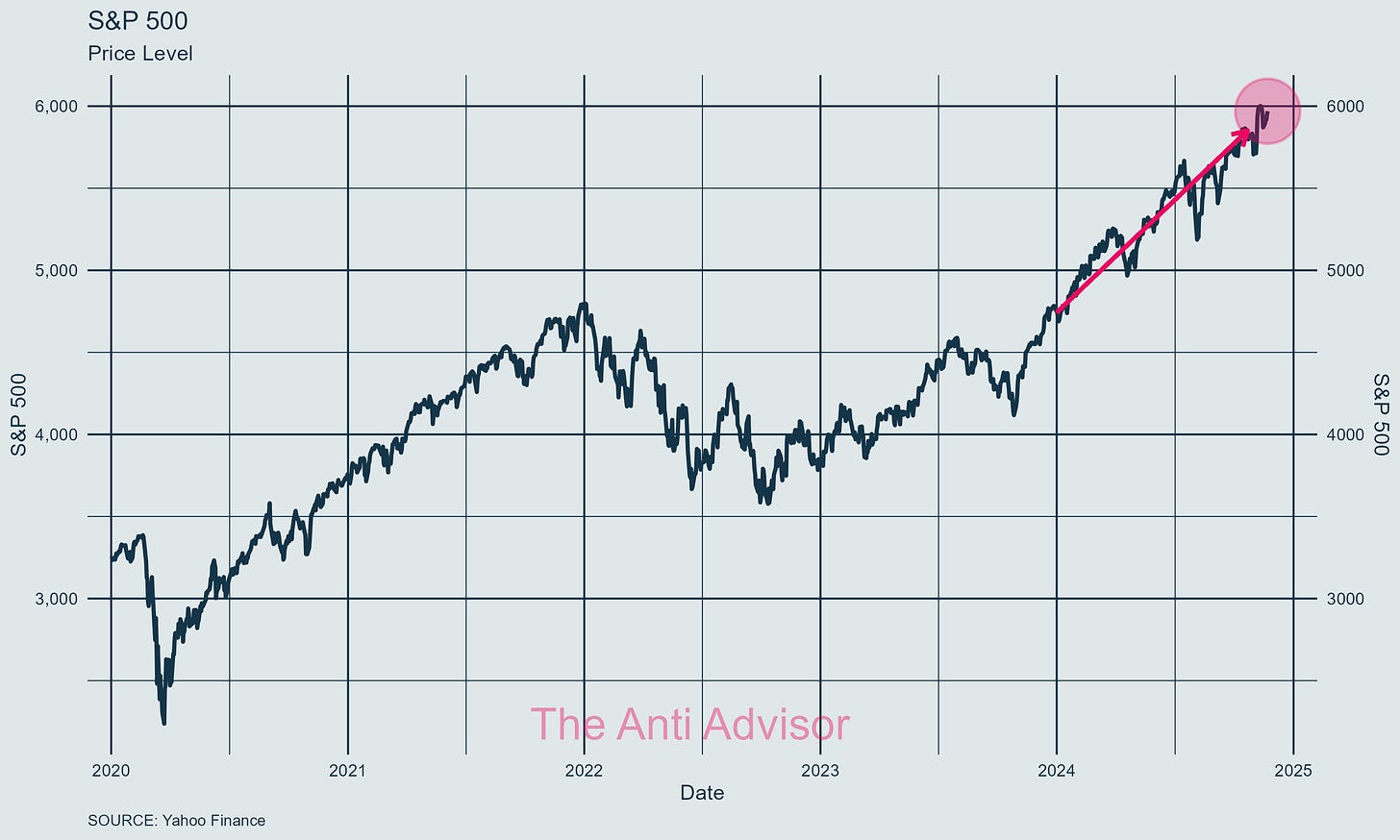

WHY THIS STORY NOW?

2 Reasons:

To remind people that investing is more about your emotional behavior than what you are invested in. If you are a badass with a 100% equity exposure, $10 million account and have no problem with a $3.3 million loss in less than a month, then that is all you. Most people can’t do that.

The market narrative feels like déjà vu from 2019, with similar complaints about missed gains. The S&P 500 has delivered a 26% return, bond markets are doing well, and cryptocurrencies are soaring alongside other asset classes.

We position our portfolios according to our research and analytics and will continue to adjust as more economic and market data is realized. For everyone trying to FOMO into this market, I will leave you with this quote from Howard Marks, co-founder of Oaktree Capital Management:

"The most dangerous thing is to invest when you feel you have to 'catch up.' That's purely emotional, and it's usually wrong. The best investments are made when you feel most uncomfortable."